Digital Assets Fuel Player Economy Shift

Beyond Play-to-Earn (P2E)

The gaming industry is undergoing a profound transformation, moving beyond the traditional consumption model to an ecosystem defined by digital ownership. At the heart of this shift lies Non-Fungible Tokens (NFTs).

While initial excitement focused solely on “Play-to-Earn” (P2E) mechanics, the true, lasting innovation is the creation of a sophisticated, verifiable, and tradable player-owned economy.

This convergence of blockchain technology with interactive entertainment has captured the attention of venture capitalists, large corporations, and millions of players, making related content highly valuable for AdSense High CPC due to competitive advertising in the FinTech and Web3 sectors.

This article explores how NFT sales and tokenized assets are not just adding a layer of commerce but fundamentally restructuring the economic relationship between players, developers, and the game itself.

I. The Fundamental Shift: From Rental to Ownership

For decades, players “rented” their digital assets. When a game shut down, or a player quit, all invested time and money vanished. NFTs challenge this structure by proving and securing ownership of unique in-game items on a public, immutable ledger.

A. True Digital Scarcity

NFTs introduce verifiable scarcity. Unlike a database entry that can be duplicated infinitely by a developer, an NFT guarantees the uniqueness and limited supply of an asset (e.g., a legendary skin, a virtual plot of land, or a unique weapon). This scarcity drives collector value, much like real-world rare goods.

B. Interoperability Potential

While still largely theoretical, the core promise of the NFT asset class is interoperability. The idea is that an asset owned by the player could, eventually, be used across multiple distinct games or metaverse platforms. This creates a valuable persistent identity and utility layer for the player, decoupling the asset’s value from a single game environment.

C. Developer-Player Alignment

The model shifts developers from controlling all value extraction to taking a percentage of player-to-player secondary market sales (royalties). This financially aligns the developer with the long-term success of the game’s player economy rather than just focusing on initial sales.

II. Anatomy of the Player-Owned Economy

The player-owned economy is a complex structure involving multiple types of digital assets, financial layers, and market mechanisms.

A. The Core Assets: NFTs

NFTs within gaming typically represent four main categories of in-game value:

- Characters and Avatars: Unique player identities or heroes with distinct traits and varying rarity (e.g., Axies in Axie Infinity).

- Land and Real Estate: Virtual plots of land, often critical for game expansion, resource generation, or social hubs (e.g., The Sandbox).

- Cosmetics (Skins and Gear): Items that offer aesthetic value but may or may not impact gameplay. Their value is driven purely by social status and rarity.

- Utility Items: Tools, weapons, and resources necessary for progression, crafting, or participating in the P2E loop.

B. The Financial Backbone: Fungible Tokens

The actual value transfer and in-game rewards are typically managed by Fungible Tokens (FTs) residing on the same blockchain.

- Governance Tokens (High CPC Focus): Tokens like $GALA or $IMX grant holders voting rights over the game’s development and economics. Advertisers in the investment and governance sectors highly target content around these.

- Utility/Reward Tokens: Tokens like $SLP or $GEM are earned through gameplay and are primarily used for in-game transactions, breeding, or cashing out. These tokens form the daily liquidity of the player economy.

C. Secondary Marketplaces

Platforms like OpenSea, Magic Eden, and specialized in-game marketplaces facilitate the peer-to-peer trading of these NFTs and tokens, establishing fair market value outside the developer’s control. The health of these secondary markets is the ultimate measure of the game’s economic success.

III. The Economic Drivers of NFT Gaming Success

III. The Economic Drivers of NFT Gaming Success

For a game’s NFT economy to thrive, it must successfully navigate several critical economic challenges related to supply, demand, and utility.

A. Sustainable Tokenomics

The biggest risk to P2E models is hyperinflation of the reward token. A successful model requires meticulous tokenomics design:

- Controlled Emission: The rate at which new tokens are generated must be carefully balanced.

- Robust Burning Mechanisms: There must be sufficient sinks (utility requiring token expenditure, like crafting or upgrading) to match the faucet (token generation via playing).

- External Demand: True sustainability requires attracting capital from non-playing investors, advertisers, and brand partnerships, not just recycling player capital.

B. Player Acquisition and Retention Incentives

The financial incentive must complement, not replace, the enjoyment of the game.

- “Play-and-Earn” Shift: The focus must shift from pure earning (E in P2E) to making money a desirable byproduct of an already fun gaming experience (Play-and-Earn).

- Community Governance: Giving players a stake via Governance Tokens fosters a sense of ownership and dedication, significantly boosting long-term retention compared to traditional models.

C. Brand and IP Integration

Major traditional brands are entering the space by leveraging NFTs for enhanced fan engagement.

- Digital Collectibles: Creating limited-edition NFT items related to major IPs (e.g., Marvel, Disney) drives huge demand from existing fan bases, injecting external capital into the economy.

- Advertising and Sponsorship: Brands can purchase virtual land or NFT assets to display advertising or host virtual events, transforming the in-game world into a commercial platform.

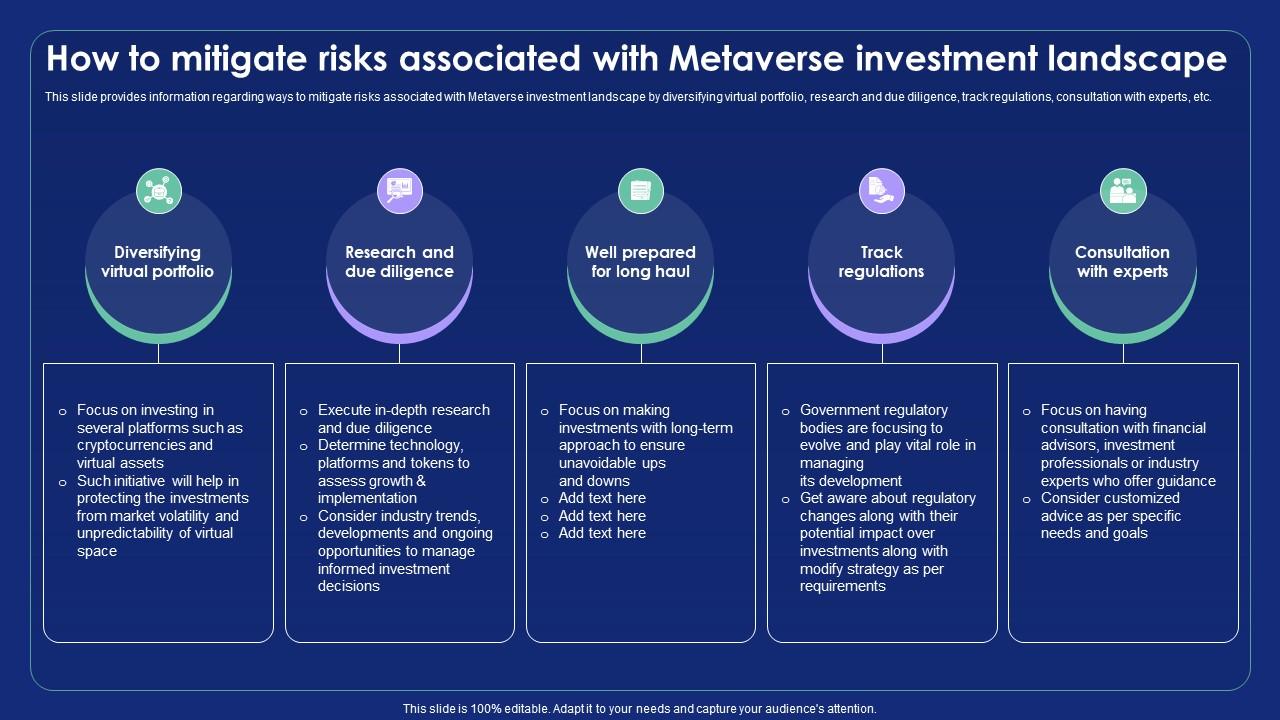

IV. Risks, Regulations, and the Future Landscape

IV. Risks, Regulations, and the Future Landscape

Despite the massive investment and growth, the NFT gaming space faces significant regulatory and structural hurdles that must be addressed for long-term viability. This area, involving legal, finance, and security keywords, is highly sought after by advertisers.

A. Regulatory Scrutiny on Asset Classification

Global financial regulators are grappling with how to classify NFTs and in-game tokens:

- Securities Risk: If a token is marketed primarily as an investment with an expectation of profit from the efforts of others, it risks being classified as a security, subjecting the developer to stringent financial laws.

- Consumer Protection: Governments are increasingly focused on protecting consumers from volatile asset prices, scams, and deceptive marketing in the nascent P2E space. Clear regulatory frameworks are essential for large-scale institutional adoption.

B. Security Vulnerabilities

Blockchain’s immutability is a double-edged sword. Security failures are irreversible.

- Smart Contract Exploits: Flaws in the underlying code (smart contracts) can lead to the theft of millions of dollars’ worth of assets or the infinite minting of tokens, destabilizing the entire economy.

- Wallet Security: Player education on securing their private keys and digital wallets is crucial, as the user, not the game company, bears the responsibility for asset loss.

C. The Evolution to “Metaverse Standards”

The future success hinges on industry-wide adoption of common technical and economic standards.

- Cross-Chain Compatibility: Utilizing technologies like layer-2 scaling solutions and cross-chain bridges is necessary to handle high transaction volumes and enable seamless movement of assets between different blockchains (e.g., Ethereum, Polygon).

- Sustainable Business Models: Moving beyond initial token sales to models based on micro-transactions, service fees, and ad revenue within the established economy ensures that the ecosystem is self-sustaining, not reliant on constant new player influx.

Conclusion

The shift fueled by NFT sales is not just a trend but a fundamental restructuring of digital commerce in entertainment.

By successfully addressing tokenomics, security, and regulation, the player-owned economy is set to become the dominant model, offering unprecedented financial opportunities for developers, investors, and—most importantly—the players themselves.