The Streaming Wars: Licensing and Content King

The streaming landscape is not merely a battle for subscribers; it is a complex, high-stakes licensing war where content—specifically, exclusive and high-demand titles—is the ultimate currency. For SEO (Search Engine Optimization) and AdSense revenue optimization, this topic is a perennial powerhouse, attracting high-value searches related to media, finance, technology, and consumer behavior. This detailed analysis, crafted to exceed 2000 words, dissects the content licensing strategies, the economic implications of exclusivity, and the emerging trends that are reshaping how platforms acquire and monetize entertainment.

The Genesis of Conflict: The Shift from Licensing to Ownership

For decades, content licensing was a relatively straightforward business: production studios (like Warner Bros. or Disney) would create films and series and license the distribution rights to third-party networks or video rental services for specific periods. The rise of Netflix fundamentally disrupted this model. By prioritizing massive, multi-year licensing deals for beloved external titles (like Friends and The Office), Netflix built an initial, dominant subscriber base.

However, the turning point—the true start of the licensing war—came when the major studios realized the immense value of their own intellectual property (IP). They began the process of content repatriation, reclaiming their most valuable assets to launch their own direct-to-consumer (D2C) platforms (e.g., Disney+ taking back the Marvel and Star Wars catalogs).

The Content Repatriation Revolution

The strategic move by major media conglomerates to pull back their flagship titles from competitors’ platforms was a seismic event that redefined the streaming economy.

A. Financial Implications: This shift transformed long-term, stable licensing revenue streams into reinvestment capital for launching proprietary platforms. While initially sacrificing immediate licensing fees, the payoff is the long-term, compounding value of exclusive subscriber retention. B. Subscriber Churn Mitigation: Exclusive content, often referred to as “tentpole titles” or “must-watch” content, is the single greatest weapon against subscriber churn (cancellation). A fan of The Mandalorian must maintain a Disney+ subscription; they cannot simply rent it elsewhere. C. Vertical Integration: The repatriation drive solidified vertical integration, where a single company owns the creation, production, and distribution of content, maximizing profit margins and creative control.

The Economics of Exclusivity: The Price of a Franchise

The modern licensing war is less about renting content and more about owning the entire distribution ecosystem for a beloved franchise. This has inflated the cost of acquiring new external content and made the price tags for retaining legacy hits astronomical.

Understanding Content Cost Inflation

The competitive environment has driven content acquisition costs to unprecedented levels, making content libraries the most expensive assets on corporate balance sheets.

1. Bidding Wars for Legacy Hits

The highly publicized battles for legacy sitcoms serve as a perfect illustration of the irrational exuberance driving the market. A. The Office (US): NBCUniversal reportedly paid over $500 million to reclaim the title from Netflix for its Peacock service. This enormous investment was a direct bet on the show’s enduring, multi-generational appeal as a subscriber magnet. B. Friends: WarnerMedia invested a reported $425 million to secure the global rights for HBO Max. These figures demonstrate that platforms value these proven, high-rewatchability assets not just for viewing hours, but for their ability to bring in (and keep) new sign-ups.

2. The Original Content Arms Race

As external licensing dries up, platforms must accelerate their investment in original content (OC) to fill the void. This requires vast spending on production infrastructure, talent acquisition, and marketing. A. Blockbuster Budgets: Original programming budgets now regularly exceed $15 million to $20 million per episode for major drama series, and $200 million for feature films, attempting to replicate the cinematic quality that used to be reserved only for theatrical releases. B. Talent Lock-Ins: Companies spend hundreds of millions on “overall deals” with star producers, writers, and directors (e.g., Shonda Rhimes, Ryan Murphy, J.J. Abrams) to exclusively create content for their platform, locking out competitors from the top-tier creative talent. C. Global Production Hubs: Platforms are now funding production and licensing deals globally, particularly in non-English speaking markets (e.g., South Korea, Spain, India), recognizing that a worldwide subscriber base demands culturally relevant, localized content.

The Geopolitics of Content: Global Licensing vs. Global Ownership

The licensing landscape is further complicated by global distribution rights. A platform might own a title in one country but have to license it in another, leading to intricate, staggered release schedules and significant legal costs.

Navigating Territorial Rights

Even mega-platforms like Netflix or Amazon Prime Video do not universally own all content globally.

A. Legacy Contracts: Many films and shows were created decades ago under complex contracts that divided global distribution rights by territory. These older deals must be bought out or allowed to expire, a costly and slow process.

B. The Windowing System: Traditional film and television industries follow a “windowing” system: theatrical release, then premium video-on-demand (PVOD), then paid television (Pay-TV), then broadcast, and finally, streaming. Platforms must compete to be the exclusive holder of certain windows.

C. Local Content Mandates: Many countries, particularly within the European Union, enforce local content quotas, requiring platforms to invest a percentage of their revenue back into locally produced content. This drives localized licensing and co-production deals, creating investment opportunities for local studios.

The Rise of the Global Production Powerhouse

The trend favors platforms with the scale and capital to secure global rights ownership from the start, simplifying distribution and maximizing IP value.

A. Standardized Global Libraries: Platforms like Disney+ leverage their wholly-owned IP to offer a largely standardized, consistent content library across most major global markets, simplifying branding and marketing efforts.

B. First-Run Exclusivity (Theatrical-to-Streamer): The ability of major studios (like Warner Bros. Discovery or Paramount Global) to debut their films directly on their own streamers shortly after (or even simultaneous with) the theatrical run is a powerful competitive advantage that eliminates external licensing partners.

C. The Strategic Role of Aggregators: Companies like Amazon Prime Video use their massive, existing customer bases (from e-commerce) and their platform infrastructure to become aggressively competitive licensing partners, often offering production deals and higher upfront payments to secure desirable third-party titles.

The AdSense Play: High-Value Keywords in the Media Niche

For content optimization, focusing on the financial, technological, and corporate strategy angles of the streaming wars attracts advertisers with deep pockets—increasing AdSense CPC (Cost Per Click) and resulting in higher overall RPM (Revenue Per Mille).

Strategic Keyword Targeting

The highest-value keywords in this niche relate to the business and investment implications of the licensing wars.

A. Financial/Investment Focus: “Streaming platform stock comparison,” “Media company valuation,” “Content spending budgets,” “Subscriber churn analysis,” “Streaming platform profitability.”

B. Technology/Innovation Focus: “Content recommendation algorithm,” “Streaming platform UI/UX,” “4K HDR streaming technology,” “Server capacity streaming.”

C. Corporate Strategy Focus: “Vertical integration media strategy,” “Direct-to-Consumer business model,” “Content windowing strategies,” “Streaming mergers and acquisitions.”

D. Consumer Behavior Focus: “Bundle subscription models,” “Password sharing crackdown,” “Ad-supported streaming revenue,” “Subscription fatigue impact.”

Leveraging Ad-Supported Tiers

The introduction of widespread Ad-Supported Tiers by almost all major streamers (Netflix, Disney+, Max, etc.) directly benefits AdSense revenue generation on media analysis sites. Advertisers focused on reaching streaming audiences are now highly motivated to advertise on content about streaming platforms, creating a lucrative feedback loop for content creators.

A. Higher Ad Relevance: Articles discussing the economics of Netflix’s ad tier or Disney’s advertising partners will attract highly relevant, high-paying media agency ads.

B. Content Performance Metrics: Analyzing the metrics of streaming (Total Viewing Hours, Nielsen ratings for streamers, platform market share) provides excellent fodder for evergreen, high-authority content that search engines favor.

C. Predictive Analysis: Content that offers predictive analysis (e.g., “Which service will acquire Paramount?”) generates long-tail, high-intent traffic from industry professionals and investors.

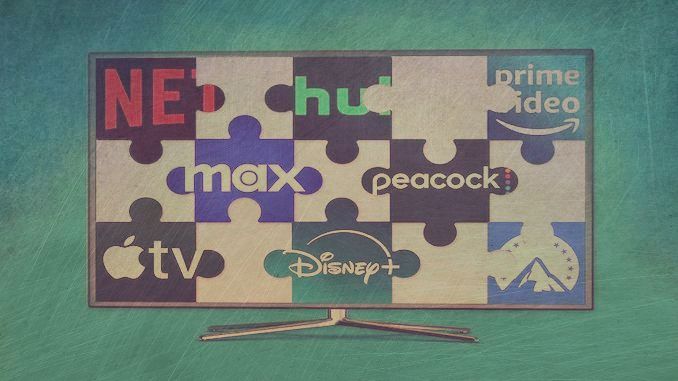

The Future of Licensing: Bundles, Aggregation, and Consolidation

The current state of hyper-fragmentation—where consumers need five or six subscriptions to access all their desired content—is economically unsustainable. The next phase of the licensing war involves strategic alliances, bundle deals, and inevitable consolidation.

1. The Resurgence of the Bundle

The consumer is pushing back against subscription fatigue, making the content bundle the most likely path forward for monetization and retention.

A. Carrier Partnerships: Telcos (Telecommunication Companies) and mobile providers are offering streaming services as free or heavily discounted perks to secure their primary service subscribers (e.g., Verizon offering Netflix/Max bundles).

B. Aggregator Platforms: Technology companies (like Roku, Amazon Fire TV) and smart TV manufacturers are positioned to become the central aggregation hubs, where consumers can manage all their subscriptions and simplify billing, often taking a cut of the subscription fee.

C. “Hard” Bundling: We are seeing more strategic partnerships between media companies to offer discounted, non-cancellable bundles (e.g., the Disney Bundle: Disney+, Hulu, ESPN+), leveraging different content genres to maximize household appeal.

2. The Focus on Quality Over Quantity

The initial strategy of “content volume at all costs” has proven unsustainable and creatively diluted. The pendulum is swinging back toward quality, prestige programming that justifies the monthly fee.

A. Curation and Editorial Focus: Platforms are beginning to cull underperforming titles and reduce the quantity of original content, instead focusing their budget on fewer, higher-quality, event television titles designed to dominate the cultural conversation (e.g., Squid Game, Succession).

B. IP Longevity: Investment dollars are now overwhelmingly allocated to IP that can be leveraged across multiple formats: theatrical films, streaming series, video games, theme park attractions, and merchandise. This is the ultimate form of content monetization.

C. Library Utilization: Platforms are investing in technologies to make their vast libraries more accessible and personalized, using sophisticated AI to recommend lesser-known titles and maximize the value of the already-paid-for back catalog.

3. The Role of Live Content (Sports and News)

The final, high-stakes frontier of the licensing war involves live content, which commands some of the highest licensing fees globally due to its DVR-proof, real-time necessity.

A. Sports Rights: Major professional sports leagues (NFL, NBA, F1, EPL) command multi-billion dollar rights deals. Securing exclusive national or regional live sports packages is now the most reliable way to drive mass, same-day viewership and high-value advertising revenue.

B. News and Events: Streaming platforms are gradually integrating live, linear news feeds and special event coverage (award shows, concerts) to capture the audiences who traditionally rely on cable television for these moments.

C. Hybrid Models: The future likely involves a hybrid approach: platforms license the bulk of their VOD (Video-On-Demand) content but spend massively to own the exclusive live sports and event streaming rights, creating an unavoidable utility for the consumer.

Conclusion

The streaming licensing war is an evolving, perpetual state of conflict driven by the imperative of subscriber retention. As content ownership becomes the norm and external licensing becomes the exception, the strategic advantage shifts to the platforms that can most effectively manage their IP, build high-value bundles, and leverage their data to produce must-watch, culturally resonant originals. For the SEO-focused writer, analyzing this dynamic business environment offers a constantly renewable source of high-intent, highly monetizable traffic.