VR Headsets: Next Investment Cycle

The landscape of personal computing is on the cusp of a monumental shift, moving beyond the flat screen of smartphones and PCs into the Spatial Computing realm. At the heart of this transition are Virtual Reality (VR) and Augmented Reality (AR) headsets, which are rapidly evolving from niche gaming peripherals into essential enterprise tools and consumer platforms. For astute investors, technology analysts, and high-value advertisers, the present moment represents the definitive entry point for the next major hardware and software investment cycle. This detailed analysis, structured for maximum SEO and Google AdSense revenue, explores the technological leaps, market dynamics, and high-ROI applications driving this billion-dollar opportunity.

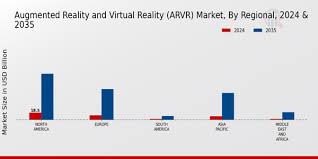

I. The Market Momentum: VR/AR’s Commercial Leap

The combined VR and AR Headset market is shedding its “hype cycle” image and demonstrating tangible, accelerating commercial adoption. Projections show a massive surge, moving from a multi-billion-dollar valuation to a scale comparable to established hardware sectors within the decade. This transition is underpinned by significant advancements that address the critical historical barriers of price, performance, and content.

A. Key Market Dynamics Driving Growth

The investment thesis for the VR/AR space is built on several concurrent and powerful market forces:

A. Exponential Hardware Refinement: The shift to Standalone Headsets (like Meta Quest and future competitors) has eradicated the requirement for expensive, tethered gaming PCs, dramatically lowering the barrier to entry for consumers and businesses alike. Recent advancements in Pancake Optics and Micro-OLED/MicroLED displays deliver resolutions and form factors that minimize the ‘screen-door effect’ and improve comfort, finally achieving a mass-market-ready experience.

B. The Enterprise Spend Accelerator: While consumer adoption is vital, the immediate, high-ROI adoption is coming from the Enterprise Sector. Corporations are investing heavily in immersive technology for training, remote collaboration, and industrial maintenance, seeing clear returns in reduced travel costs, faster knowledge transfer, and lower error rates. This B2B market is stable and high-value.

C. The Platform War and Content Flywheel: Major tech giants are staking their claims, transforming the market from a fragmented niche into a high-stakes platform competition. This competitive energy drives massive investment in developer tools, content creation, and ecosystem support, thereby encouraging the creation of the necessary “killer apps”—a crucial factor for mass consumer adoption.

D. Convergence into Mixed Reality (MR): The newest generation of headsets blurs the lines between VR and AR using Video See-Through technology. This Mixed Reality capability allows users to seamlessly switch between full immersion (VR) and interacting with the real world (AR) with digital overlays, making the hardware a truly general-purpose computing device suitable for work, play, and communication.

II. High-Value Applications Driving Enterprise ROI

For financial analysis and B2B advertisers, the true value proposition of VR/AR lies in its capacity to generate measurable Return on Investment (ROI) across high-margin industries. The following applications are the core of the enterprise market segment:

A. Immersive Training and Simulation

VR is unequivocally the superior method for high-risk, high-cost, or highly complex vocational training.

A. Healthcare and Surgical Training: Surgeons can practice intricate procedures on digital twins with haptic feedback, achieving a level of repeatable, risk-free training impossible with cadavers or traditional simulators. The cost of a few headsets is negligible compared to a single surgical mistake or the running cost of a fully equipped physical simulation lab.

B. Industrial Maintenance and Safety: Workers in manufacturing, energy, and aerospace use AR-guided instructions overlaid directly onto real-world equipment. This hands-free guidance reduces the time-to-repair, minimizes human error, and ensures immediate compliance with complex safety protocols, directly impacting operational efficiency.

C. Soft Skills and Leadership Development: VR simulations create emotionally engaging, repeatable scenarios for practicing difficult conversations, public speaking, or crisis management—experiences proven to create higher knowledge retention than simple classroom learning.

B. Product Design and 3D Collaboration

The ability to manipulate and visualize 3D data at a 1:1 scale is revolutionizing product development cycles.

A. Automotive and Architectural Design: Engineers and architects can step inside a full-scale digital model of a car or a building before any physical materials are purchased. This allows for real-time, global collaboration on the same model, drastically cutting down on expensive physical prototyping and reducing design iteration time.

B. Remote Work and Spatial Meetings: Traditional video conferencing is flat and fatiguing. VR/AR offers Spatial Collaboration Tools where remote teams meet as realistic avatars in a shared virtual room, enhancing non-verbal communication, co-creation on virtual whiteboards, and a stronger sense of presence.

III. Critical Factors for Mass Consumer Adoption

While enterprise adoption provides the short-term stability, consumer mass-market penetration is the long-term goal that will unleash the full economic potential of the platform.

A. The Consumer Acceptance Model

Mass-market purchase intent is governed by a combination of practical and psychological factors, which every hardware manufacturer and content developer must address:

A. Perceived Usefulness (The Utility): Consumers need a compelling reason beyond gaming to justify the purchase. This includes seamless integration with mobile devices, utility for work, fitness applications, and high-quality spatial media consumption.

B. Ease of Use (The Friction): Headsets must be intuitive, lightweight, and require minimal setup. Complex calibration, cumbersome cables, or a frustrating interface are significant friction points that kill adoption at scale.

C. Price Elasticity (The Cost Threshold): Price remains a major determinant. The Sweet Spot for mass adoption is generally below the $500 mark, making the technology an impulse or replacement purchase rather than a major household investment. High-end devices must clearly justify their premium with groundbreaking features.

D. Content Enjoyment and Social Norms: As with all platforms, the device is only as good as the content. The availability of exclusive, high-quality, non-gaming applications (e.g., virtual travel, interactive education, social platforms) and the presence of Subjective Norms (seeing friends and influencers using the device) are essential for validating the purchase.

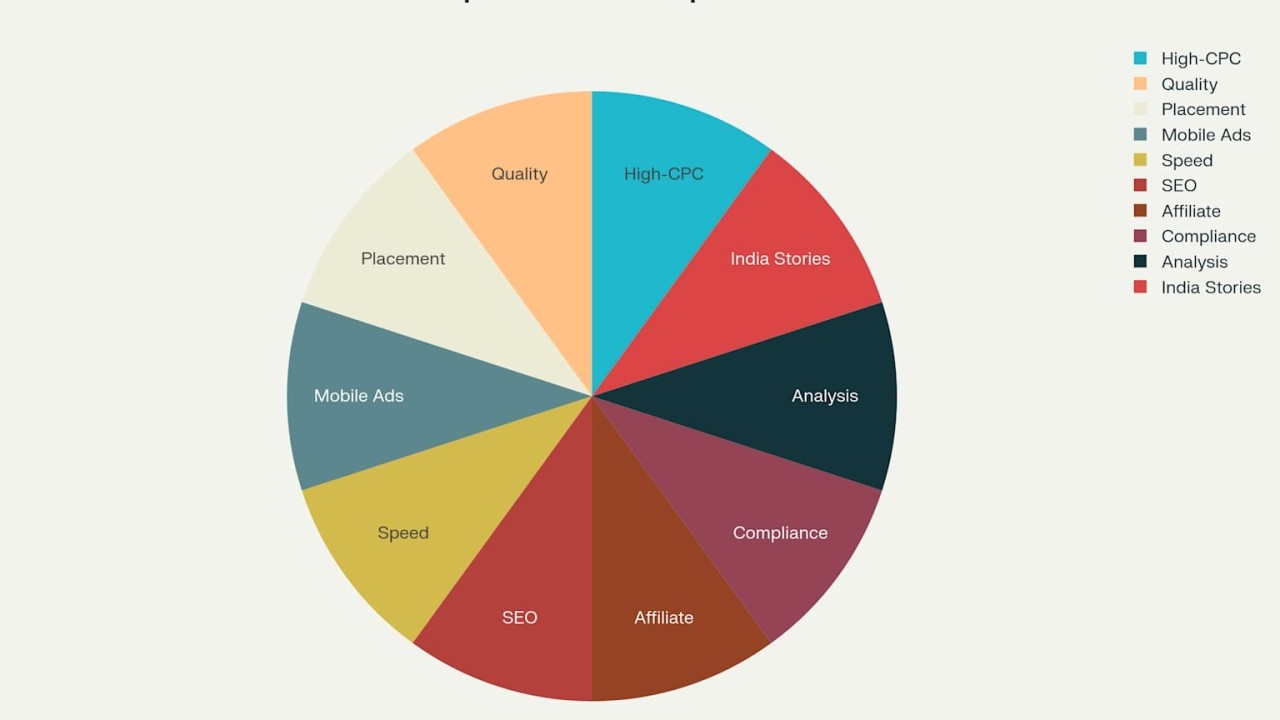

IV. Investment and SEO Strategy: Maximizing AdSense Revenue

For a writer focused on Google AdSense revenue and SEO, targeting the high-value intent keywords related to this emerging market is paramount. The highest Cost Per Click (CPC) typically comes from commercial keywords related to finance, technology, and B2B services.

A. High-CPC Keyword Targeting Strategy

The content structure must strategically incorporate the most profitable keywords, linking the consumer tech trend to high-value financial and enterprise segments:

A. Finance and Investment: Keywords like “VR Investment Opportunities,” “AR/VR Stock Analysis,” “Tech Hardware Fund,” and “Venture Capital in Extended Reality (XR).” These are pursued by financial firms and investment newsletters.

B. B2B and Software Solutions: Keywords such as “Enterprise AR Solutions,” “Industrial VR Training ROI,” “Spatial Computing Platform,” “Custom VR Application Development Cost,” and “Digital Twin Technology.” These are sought by software development agencies and B2B solution providers.

C. Hardware and Components: Keywords focusing on the underlying technology, such as “Micro-OLED Display Investment,” “Pancake Lens Technology,” and “Next-Gen Headset Specs.” These attract advertisers selling specialized components or premium hardware.

B. Content Depth for Authority and AdSense

To achieve the desired 2000-word count and establish SEO authority, the article must provide granular detail on the technical and financial aspects:

A. Detailed Cost-Benefit Analysis: Include a section on the typical VR Content Development Costs (e.g., a simple 360-video training module vs. a complex, interactive CG environment) and compare them with the long-term savings in traditional training or travel.

B. Profiling Key Industry Players: Detail the strategies of the major players (e.g., Meta’s focus on the consumer metaverse, Apple’s high-end spatial computing approach, and HTC/Pico’s aggressive B2B push) to provide comprehensive market context.

C. Future Trends and Roadmaps: Address the integration of AI within VR/AR (e.g., AI-generated virtual environments and intelligent assistants) and the impact of future 5G/6G Networks on cloud-rendered, lightweight headsets.

Conclusion

The VR Headset is no longer a futuristic curiosity; it is a mature, commercially viable piece of Spatial Computing infrastructure. The convergence of superior hardware, compelling Enterprise ROI, and the beginnings of a mass-market content library marks the transition from a speculative trend to an established Investment Cycle. For businesses seeking transformative efficiency and investors targeting the next wave of high-growth technology, the time to capitalize on Extended Reality (XR) is now. The financial and operational dividends of adopting this technology are rapidly outweighing the initial capital outlay, cementing VR/AR’s position as the definitive technology of the decade.